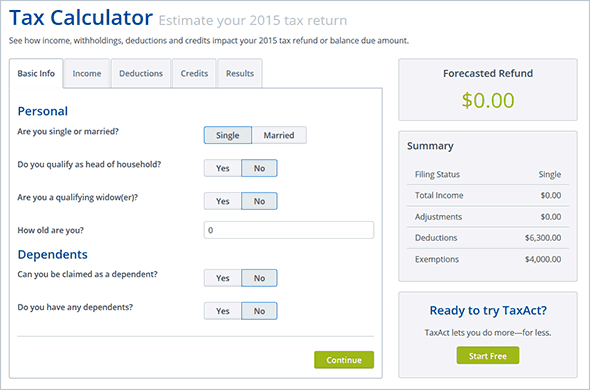

Tax act refund calculator

Continue with the interview process to enter your information. From within your TaxAct return Desktop click Tools in the options bar then click Tax Calculator.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

. Taking advantage of deductions. To use the Tax Calculator on the TaxAct Website. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. I To receive your payment you must have filed a complete 2020 tax return by October 15 2021. Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable.

Answer the simple questions the calculator asks. However if you applied for an Individual Taxpayer Identification Number ITIN but did not receive it by October 15 2021 you must have filed your complete 2020 tax return on or before February 15 2022. This tool uses the latest information provided by the IRS including changes due to tax reform and is current and valid for 2021 taxes.

This is an optional tax refund-related loan from MetaBank NA. Any qualified medical expenses that exceed 75 of your adjusted gross income for the year AGI can be deducted from your tax bill. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

In other words you might get different results for the 2021 tax year than you did for 2020. This calculator is for 2022 Tax Returns due in 2023. 1 Free Tax Refund Estimator In 2022 Turbotax Taxcaster 0 Estimates change as we learn more about you Income.

Use this 1040 Income Tax Calculator to estimate your tax bill or refund. As you answer the questions you will see that the information you enter. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. If you owe you have more time to gather the money.

Loans are offered in amounts of 250 500 750 1250 or 3500. Our tax refund calculator will show you how. Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

You have to give a reasonable estimate. Keep timing in mind As mentioned above you. On the results screen click the Printer Icon if you want to print the results.

Rest assured that our calculations are up to date with 2021 tax brackets and all tax law changes to give you the most accurate estimate. If you get a refund you can plan how you will use the funds. This tax calculator will be updated during.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The first step is to keep an organized file of your receipts. Because tax rules change from year to year your tax refund might change even if your salary and deductions dont change.

There are a variety of other ways you can lower your tax liability such as. Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe. Remember this does not apply to expenses for which you are reimbursed such as through your insurance.

Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. On the TaxAct Website click the Tax Tools dropdown.

Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. Return to place in article. You dont have to be 100 exact.

Tax act refund calculator Kamis 01 September 2022 Edit. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Enter your information for the year and let us do the rest. It is not your tax refund. Use your income filing status deductions credits to accurately estimate the taxes.

No Matter What Your Tax Situation Is TurboTax Has You Covered. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. If your tax situation changes you can always come back to the calculator again.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Flat Interest Rate Vs Diminishing Balance Interest Rate Excel Based Calculator To Convert Between Flat Diminish Interest Rates Finance Guide Personal Loans

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

See Your Refund Before Filing With A Tax Refund Estimator

4 Tips For Organizing Your Tax Information Taxact Blog Business Tax Deductions Small Business Tax Deductions Small Business Deductions

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

You Are Losing These Benefits If You Didn T File Itr Till Now Income Tax Return Tax Return Benefit

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

When To Expect Your 2022 Irs Income Tax Refund

5 Quick Tips For Doing Your Own Taxes Meet Penny Diy Taxes Budgeting Money Money Saving Plan

Here S The Average Irs Tax Refund Amount By State

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

See Your Refund Before Filing With A Tax Refund Estimator

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Income Tax Refund In 2022

Can Being Married Get You A Higher Tax Refund Tax Refund Legal Services Private Limited Company

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software